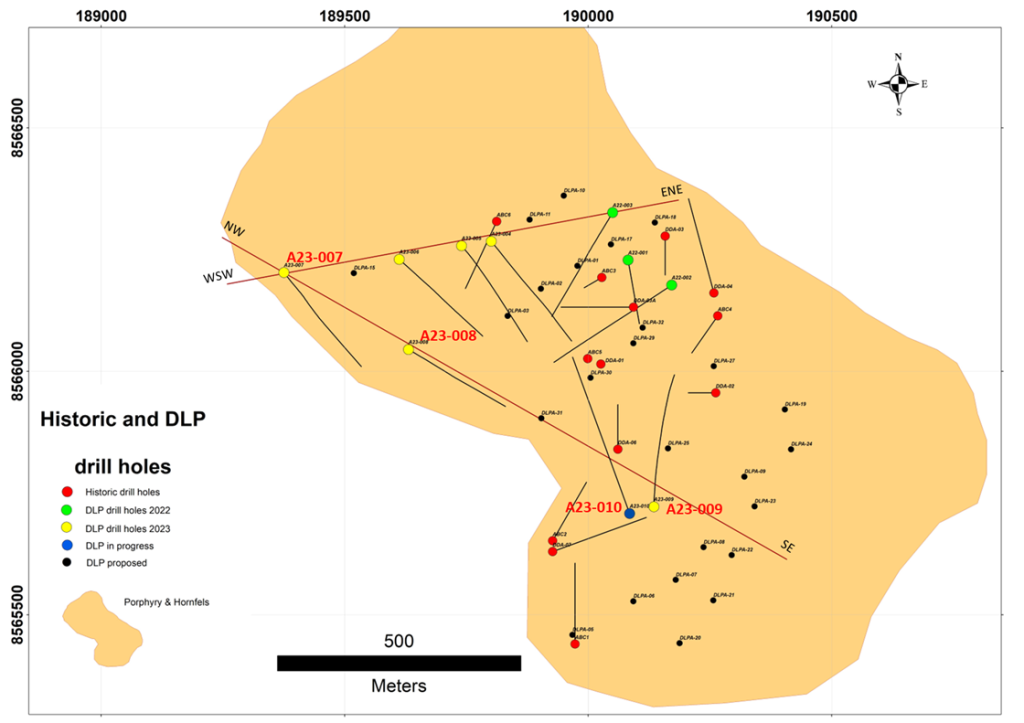

Cranbrook, British Columbia, (Newsfile Corp. – August 10, 2023) DLP Resources Inc. (“DLP” or the “Company”) (TSXV:DLP) (OTCQB:DLPRF) announces receipt of complete drill results for drillhole, A23-009 on the Aurora porphyry copper-molybdenum project in southern Peru (Figure 1).

Results for the first eight drillholes, A22-001, A22-002, A22-003, A23-004, A23-005, A23-006, A23-007 and A23-008 were released on July 24, 2023 (see DLP Resources Inc. news release of July 24 and Tables 3, 4 and 5 below).

Drillhole A23-009 was drilled approximately 868m SE of drillhole A23-007. A23-009 intersected significant copper mineralization throughout the hole to a depth of 709.55m where it ended in copper and molybdenum mineralization. The most significant mineralized intervals included:

- 0.32% CuEq* over 790.15m (0.27% Cu, 0.0095% Mo and 2.39g/t Ag) from 0.40m to 790.15m.

- 0.44% CuEq* over 314.00m (0.37% Cu, 0.0144% Mo and 2.86g/t Ag) from 303.00m to 617.00m.

- 0.59% CuEq* over 56.00m (0.52% Cu, 0.0144% Mo and 3.46g/t Ag) from 561.00m to 617.00m.

The complete set of results for A23-009 are summarized in Table 1 below.

Mr. Gendall, President and CEO commented: “A23-009 was drilled on a step out of 868m to the SE of A23-007. This is the first hole drilled by DLP on the SE side of the Aurora project. We are extremely encouraged with the intersection of copper mineralization in A23-009 on this SE side and we will continue to drill on this side during the next six months. A23-010 is currently in progress to a depth of 1000m. The early mineralized porphyry intersections observed in A23-010 to a current depth of 800m are very encouraging. Results are expected in late August.”

Aurora Cu-Mo Project – Summary of Drill Results for A23-009

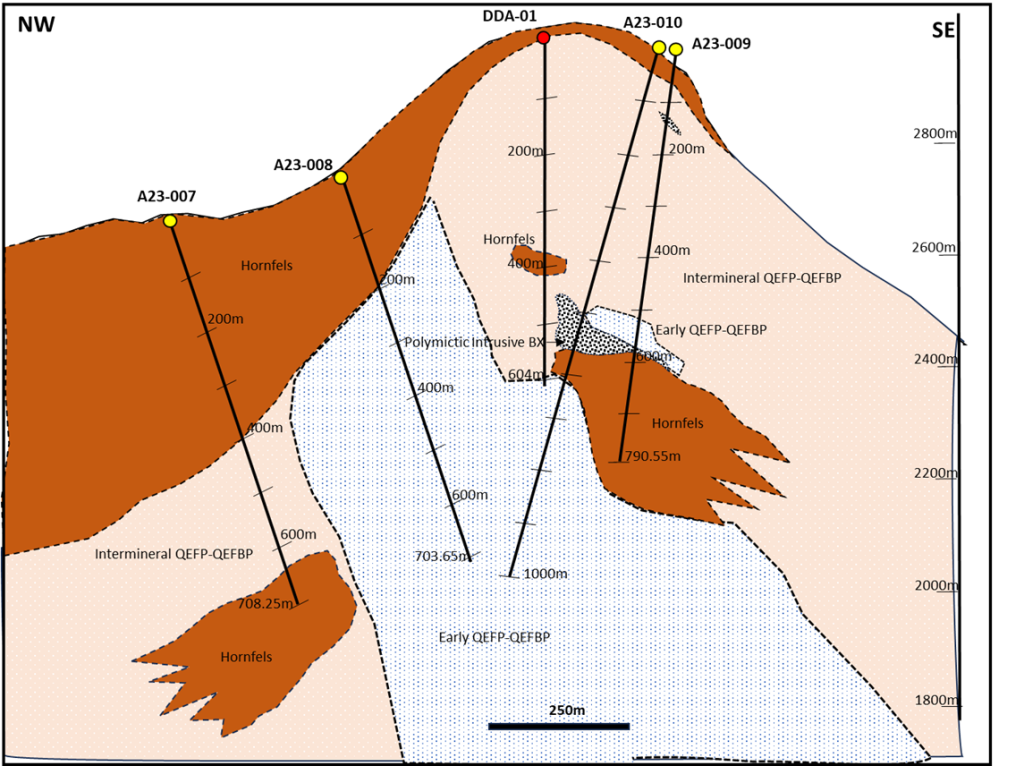

Drillhole A23-009 (Figures 2, 3 and 4) commenced on June 28 and was completed on July 14 at 790.55m. The drillhole was drilled on an azimuth of 340 degrees with a dip of -70 degrees. Coordinates are 8,565,722mN and 190,135mE at an elevation of 2966m.

- 0-0.4m: Overburden

- 0.4 – 4.35m: Hornfels

- 4.35 – 212m: Intrusive breccia with QEFP (quartz-eye-feldspar porphyry) and QEFBP (quartz-eye-feldspar-biotite porphyry) with moderate chalcopyrite mineralization and weak molybdenite mineralization. Alteration is predominantly sericite with intermediate argillic overprint.

- 212 – 350m: QEFP with moderate chalcopyrite mineralization, weak molybdenite mineralization. Alteration is predominantly moderate to strong quartz-sericite alteration with pyrrhotite.

- 350 – 392m: Intrusive breccia of QEFP with hornfels clasts. Fine sulphide stringers with chalcopyrite, pyrite and pyrrhotite occur throughout. Alteration is predominantly quartz-sericite.

- 392 – 577.3m: QEFP with moderate chalcopyrite mineralization and associated pyrrhotite and trace molybdenite. Alteration is predominantly quartz-sericite.

- 577.3 – 624m: Intrusive polymictic breccia with QEFP and hornfels clasts. Moderate chalcopyrite mineralization with pyrite and trace Mo. Alteration is predominantly quartz-sericite.

- 624 – 790.55m: Silicified hornfels with micro veinlets of sulphides consisting of pyrite and chalcopyrite with disseminated pyrrhotite. Fluorite veinlets are observed in this interval.

Table 1. Summary of Drill Results for Diamond Drillhole A23-009. All grades are length-weighted averages of samples within the interval reported.

| Hole | From | To | Interval1 | Description | Cu (total) | Mo | Ag | Cueq* |

| ID | m | m | m | % | % | g/t | % | |

| A23-009 | 0.40 | 790.55 | 790.15 | Primary/Hornfels+Breccia+Porphyry | 0.27 | 0.0095 | 2.39 | 0.32 |

| Includes | 303.00 | 617.00 | 314.00 | Primary/Hornfels+Breccia+Porphyry | 0.37 | 0.0144 | 2.86 | 0.44 |

| 561.00 | 617.00 | 56.00 | Primary/Porphyry + Breccia | 0.52 | 0.0144 | 3.46 | 0.59 |

*Copper equivalent calculations use metal prices of Cu – US$3.34/lb, Mo – US$11.86/lb and Ag – US$21.87/oz.

1 Intervals are downhole drilled core lengths. Drilling data to date is insufficient to determine true width of mineralization. Mo, Cu and Ag values are uncut.

Table 2: A23-009 Diamond drillhole location, depth, orientation and inclination.

| Hole | Easting | Northing | Elevation | Length | Azimuth | Inclination |

| ID | m | m | m | Degrees | Degrees | |

| A23-009 | 190,135 | 8,565,722 | 2966 | 790.55 | 340 | -70 |

Co-ordinates are in WGS84 Zone 19S

Quality Control and Quality Assurance

DLP Resources Peru S.A.C a subsidiary of DLP Resources Inc. supervises drilling and carries out sampling of HTW and NTW core. Logging and sampling are completed at a secured Company facility situated on the project site. Sample intervals are nominally 1.5 to 2m in length. Drill core is cut in half using a rotary diamond blade saw and samples are sealed on site before transportation to the ALS Peru S.A.C. sample preparation facility in Arequipa by Company vehicles and staff. Prepared samples are sent to Lima by ALS Peru S.A.C. for analysis. ALS Peru S.A.C. is an independent laboratory. Samples are analyzed for 48 elements using a four-acid digestion and ICP-MS analysis (ME-MS61). In addition, sequential copper analyses are done and reports, soluble copper using sulphuric acid leach, soluble copper in cyanide leach, residual copper and total copper. ALS meets all requirements of International Standards ISO/IEC 17025:2005 and ISO 9001:2015 for analytical procedures.

DLP Resources independently monitors quality control and quality assurance (“QA/QC”) through a program that includes the insertion of blind certified reference materials (standards), blanks and pulp duplicate samples. The company is not aware of any drilling, sampling, recovery or other factors that could materially affect the accuracy or reliability of the data reported from 0m to 790.55m in A23-009.

Aurora Project

Aurora Project as an advanced stage porphyry copper-molybdenum exploration project in the Province of Calca, SE Peru (Figure 1). The Aurora Project was previously permitted for drilling in 2015 but was never executed. Thirteen historical drillholes, drilled in 2001 and 2005 totaling 3,900m were drilled over an area of approximately 1000m by 800m, cut significant intervals of copper and molybdenum mineralization. From logging of the only three remaining holes DDA-01, DDA-3A and DDA-3 and data now available, it appears that only three of the thirteen holes tested the enriched copper zone and only one hole drilled deep enough to test the primary copper and molybdenum zone (see DLP Resources Inc. news release of May 18, 2021)

Salient historic drillhole data of the Aurora Project are:

• 190m @ 0.57% Cu, 0.008% Mo in DDA-1 with a high-grade intercept of 20m @ 1.01% Cu related to a supergene enrichment zone of secondary chalcocite;

• 142m @ 0.5% Cu, 0.004% Mo in DDA-3;

• 71.7m @ 0.7% Cu, 0.007% Mo in DDA-3A (see historical Focus Ventures Ltd. news release July 11, 2012); and

• One of the historical holes ABC-6 drilled on the edge of the system intersected 78m @ 0.45% Cu and 0.107% Mo (Figure 2)

A review of the historical drilling indicates that the majority of the thirteen holes were drilled in the leached and partially leached zones of the porphyry system. Ten of the thirteen holes never fully tested the oxide and secondary enrichment zone and/or the primary copper zone at depth encountered in DDA-01. Copper-molybdenum mineralization is hosted by quartz-feldspar porphyries intruded into slates-hornfels and pelitic sandstones belonging to the Ordovician (439 – 463 ma) Sandia Formation.

Table 3: Aurora Drill Results for Holes A23-001 to A23-003

| Hole | From | To | Interval1 | Description | Cu (total) | Mo | Ag | CuEq* |

| ID | m | m | m | % | ppm | ppm | % | |

| A22-001 | 0.5 | 22.45 | 0.5 | Partially Leached | 0.12 | 51.23 | 2.98 | 0.16 |

| 22.45 | 388 | 365.55 | Oxidized/Mixed/Primary | 0.33 | 114.16 | 3.64 | 0.33 | |

| Includes | 22.45 | 145.8 | 123.35 | Oxidized/Mixed | 0.49 | 36.49 | 4.20 | 0.54 |

| Includes | 100.35 | 145.8 | 45.45 | Enriched | 0.64 | 17.41 | 3.40 | 0.67 |

| Includes | 100.35 | 124.3 | 23.95 | Enriched | 0.87 | 23.7 | 3.43 | 0.87 |

| Includes | 108.65 | 124.3 | 15.65 | Enriched | 1.09 | 32.75 | 3.00 | 1.10 |

| 145.8 | 172.9 | 21.1 | #Fault zone/Mixed | 0.23 | 68.79 | 1.16 | 0.27 | |

| 172.9 | 388 | 215.1 | Primary | 0.24 | 167.96 | 3.47 | 0.33 | |

| Includes | 298.85 | 326 | 27.15 | Primary | 0.48 | 31.15 | 7.01 | 0.55 |

| Includes | 366 | 388 | 22 | Primary – Mo rich | 0.21 | 573.45 | 1.43 | 0.42 |

| Hole | From | To | Interval1 | Description | Cu (total) | Mo | Ag | CuEq* |

| ID | m | m | m | % | ppm | ppm | % | |

| A22-002 | 0.10 | 89.40 | 89.30 | Leached | 0.04 | 48.38 | 0.55 | 0.04 |

| 89.40 | 208.00 | 118.60 | Partially Leached | 0.22 | 67.24 | 2.53 | 0.24 | |

| 208,00 | 422.40 | 214.40 | Oxidized/Mixed/Primary | 0.35 | 113.88 | 3.95 | 0.41 | |

| Includes | 244.00 | 296.00 | 52.00 | Primary | 0.52 | 130.55 | 4.53 | 0.53 |

| 422.40 | 479.00 | 56.60 | Primary (Late Porphyry) | 0.09 | 72.09 | 1.29 | 0.10 | |

| 479.00 | 561.60 | 82.60 | Primary – Mo rich | 0.19 | 349.49 | 1.34 | 0.20 | |

| Hole | From | To | Interval1 | Description | Cu (total) | Mo | Ag | CuEq* |

| ID | m | m | m | % | ppm | ppm | % | |

| A22-003 | 2.70 | 38.00 | 35.3 | Partially leached | 0.12 | 48.89 | 1.17 | 0.14 |

| 38.00 | 702.30 | 664.3 | Partially leached /Mixed/Enriched/Primary | 0.33 | 483.14 | 3.23 | 0.52 | |

| Includes | 38.00 | 132.00 | 94.00 | Partially leached with sulphides | 0.21 | 103.24 | 3.78 | 0.28 |

| Includes | 132.00 | 350.00 | 218.00 | Mixed sulphides/Enrichment | 0.69 | 161.77 | 5.65 | 0.79 |

| Includes | 206.00 | 350.00 | 144.00 | Enriched | 0.75 | 96.52 | 5.87 | 0.83 |

| Includes | 258.00 | 350.00 | 92.00 | Enriched | 0.83 | 71.07 | 6.81 | 0.91 |

| Includes | 350.00 | 522.00 | 172.00 | Primary (intermineral) | 0.22 | 258.80 | 2.47 | 0.33 |

| Includes | 522.00 | 702.30 | 180.30 | Primary (Moly rich) | 0.07 | 1283.78 | 0.73 | 0.51 |

Table 4: Aurora Drill Results for Holes A23-004 to A23-006

| Hole | From | To | Interval1 | Description | Cu (total) | Mo | Ag | CuEq* |

| ID | m | m | m | % | % | g/t | % | |

| A23-004 | 0 | 700.9 | 700.9 | Leached/Mixed/Enriched/Primary | 0.18 | 0.142 | 2.47 | 0.70 |

| Includes | 0 | 34 | 34 | Leached | 0.04 | 0.064 | 1.07 | 0.27 |

| 34 | 110.9 | 76.9 | Partially leached | 0.19 | 0.066 | 2.83 | 0.46 | |

| 110.9 | 333 | 222.1 | Mixed/Enriched/Primary | 0.46 | 0.056 | 5.88 | 0.72 | |

| Includes | 110.9 | 264 | 153.1 | Mixed/Enriched | 0.53 | 0.058 | 7.07 | 0.86 |

| 333 | 421 | 88 | Primary (Molybdenum rich) | 0.05 | 0.149 | 0.78 | 0.56 | |

| 421 | 502 | 81 | Primary (Molybdenum rich) | 0.12 | 0.152 | 0.84 | 0.64 | |

| 502 | 700.9 | 198.9 | Primary (Molybdenum rich) | 0.02 | 0.273 | 0.17 | 1.07 | |

| Hole | From | To | Interval1 | Description | Cu (total) | Mo | Ag | CuEq* |

| ID | m | m | m | % | % | g/t | % | |

| A23-005 | 0 | 693.4 | 693.4 | Leached/Mixed/Enriched/Primary | 0.11 | 0.144 | 1.95 | 0.64 |

| Includes | 0 | 20 | 20 | Leached | 0.03 | 0.092 | 23.23 | 0.58 |

| 20 | 130 | 110 | Partially leached | 0.12 | 0.059 | 2.79 | 0.36 | |

| 130 | 188 | 58 | Mixed/Enriched | 0.43 | 0.054 | 3.38 | 0.66 | |

| 188 | 302 | 114 | Primary | 0.14 | 0.076 | 1.38 | 0.42 | |

| 302 | 472 | 170 | Primary (Molybdenum rich) | 0.10 | 0.11 | 1.05 | 0.50 | |

| 472 | 693.4 | 221.4 | Primary (Molybdenum rich) | 0.03 | 0.259 | 0.95 | 0.95 | |

| Hole | From | To | Interval1 | Description | Cu (total) | Mo | Ag | CuEq* |

| ID | m | m | m | % | % | g/t | % | |

| A23-006 | 0 | 14.7 | 14.7 | No core recovered | – | – | – | – |

| 14.7 | 91 | 76.3 | Partially leached | 0.10 | 0.061 | 3.00 | 0.33 | |

| 91 | 708.5 | 617.5 | Mixed/Enriched/Primary | 0.17 | 0.148 | 1.82 | 0.69 | |

| Includes | 91 | 127 | 36 | Mixed/Enriched | 0.62 | 0.031 | 9.10 | 0.80 |

| 321 | 708.55 | 387.55 | Primary (Molybdenum rich) | 0.07 | 0.205 | 0.74 | 0.78 | |

| 500 | 708.55 | 208.55 | Primary (Molybdenum rich) | 0.08 | 0.260 | 0.86 | 0.98 |

Note: *Copper equivalent grades (CuEq) are for comparative purposes only. Mo, Cu and Ag values are uncut and recovery is assumed to be 100% for the entire drilled length of A23-01, A23-02, A23-003, A23-04, A23-05 and A23-06. The project is at an early stage of exploration and conceptual recoveries of Cu 85%, Mo 82%, and Ag 75% are assigned to the CuEq calculations. Conversion of metals to an equivalent copper grade based on these metal prices is relative to the copper price per unit mass factored by conceptual recoveries for those metals normalized to the conceptualized copper recovery. The metal equivalencies for each metal are added to the copper grade. The formula for this is: CuEq % = Cu% + (Mo% * (Mo recovery / Cu recovery) * (Mo $ per lb / Cu $ per lb) + (Ag g/t * (Ag recovery / Cu recovery) * (Ag $ per oz/ 31.1034768) / (Cu $ per lb* 22.04623)).

*Copper equivalent calculations use metal prices of Cu – US$3.34/lb, Mo – US$11.86/lb and Ag – US$21.87/oz.

1 Intervals are downhole drilled core lengths. Drilling data to date is insufficient to determine true width of mineralization. Mo, Cu and Ag values are uncut.

Table 5. Summary of Drill Results for Diamond Drillhole A23-007 and A23-008. All grades are length-weighted averages of samples within the interval reported.

| Hole | From | To | Interval1 | Description | Cu (total) | Mo | Ag | Cueq* |

| ID | m | m | m | % | % | g/t | % | |

| A23-007 | 0 | 708.25 | 708.25 | Partially Leached/Primary/Hornfels | 0.25 | 0.0137 | 3.07 | 0.33 |

| Includes | 0 | 99 | 99 | Partially leached/Hornfels | 0.30 | 0.0004 | 4.91 | 0.34 |

| 99 | 206 | 107 | Leached Hornfels | 0.18 | 0.0004 | 3.54 | 0.21 | |

| 206 | 406 | 200 | Primary/Hornfels | 0.37 | 0.0030 | 3.83 | 0.42 | |

| Includes | 206 | 254 | 48 | Primary/Hornfels | 0.57 | 0.0020 | 5.33 | 0.61 |

| 254 | 272 | 18 | Primary/Hornfels | 0.24 | 0.0032 | 1.78 | 0.26 | |

| 272 | 306 | 34 | Primary/Hornfels | 0.48 | 0.0030 | 6.33 | 0.53 | |

| 306 | 356 | 50 | Primary/Hornfels | 0.23 | 0.0034 | 1.91 | 0.24 | |

| 356 | 378 | 22 | Primary/Hornfels | 0.50 | 0.0030 | 5.65 | 0.55 | |

| 406 | 639.5 | 233.50 | Primary/Porphyry | 0.17 | 0.0146 | 1.88 | 0.19 | |

| 639.5 | 708.25 | 68.75 | Primary/Hornfels | 0.18 | 0.0814 | 1.51 | 0.19 | |

| A23-008 | 0 | 3.10 | 3.10 | No core Recovered | – | – | – | – |

| 3.1 | 703.65 | 700.55 | Primary/Hornfels+Porphyry | 0.10 | 0.0852 | 1.18 | 0.40 | |

| includes | 3.1 | 39 | 35.90 | Primary/Hornfels | 0.21 | 0.0035 | 2.26 | 0.24 |

| 123 | 188.55 | 65.55 | Primary/Hornfels | 0.23 | 0.0086 | 5.41 | 0.30 | |

| 402 | 703.65 | 301.65 | Primary/Porphyry | 0.03 | 0.1548 | 0.26 | 0.56 |

Note: *Copper equivalent grades (CuEq) are for comparative purposes only. Mo values are cut to 0.5% and Cu and Ag values are uncut and recovery is assumed to be 100% for the entire drilled length of A23-007 and A23-008. The project is at an early stage of exploration and conceptual recoveries of Cu 85%, Mo 82%, and Ag 75%. are assigned to the CuEq calculations. Conversion of metals to an equivalent copper grade based on these metal prices is relative to the copper price per unit mass factored by conceptual recoveries for those metals normalized to the conceptualized copper recovery. The metal equivalencies for each metal are added to the copper grade. The formula for this is: CuEq % = Cu% + (Mo% * (Mo recovery / Cu recovery) * (Mo $ per lb / Cu $ per lb) + (Ag g/t * (Ag recovery / Cu recovery) * (Ag $ per oz/ 31.1034768) / (Cu $ per lb* 22.04623)).

*Copper equivalent calculations use metal prices of Cu – US$3.34/lb, Mo – US$11.86/lb and Ag – US$21.87/oz.

1 Intervals are downhole drilled core lengths. Drilling data to date is insufficient to determine true width of mineralization. Mo values are cut to 0.5% and Cu and Ag values are uncut.

Figure 1: DLP Project areas in Peru with Aurora Project Shown.

Figure 2: Aurora Project – Simplified geology showing historic drilling and drilling by DLP in 2022-2023 with A23-009 and A23-010 (in progress) highlighted in red numbering.

Figure 3: Aurora Project – Simplified NW-SE geological section showing DLP drillholes in yellow and historic drillhole of Vena in red.

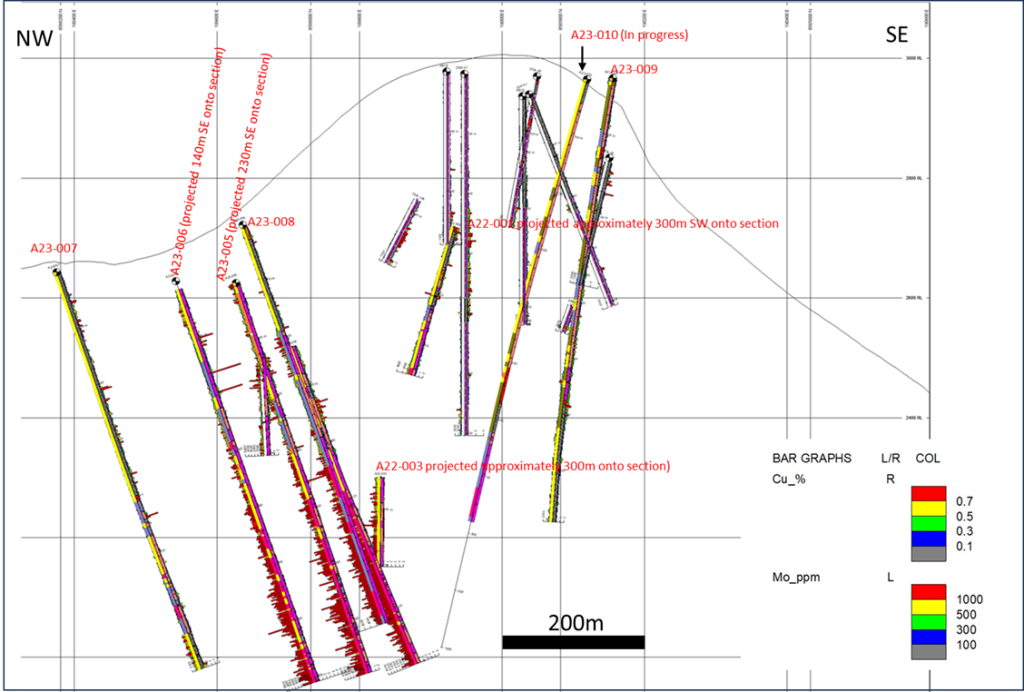

Figure 4: Aurora Project – NW-SE section showing positions of historic drilling and current DLP drillholes numbered in red. Downhole values for copper and molybdenum are shown as bar graphs for assigned intervals with Cu % on right and Mo ppm on left of drillhole.

Qualified Person

David L. Pighin, consulting geologist and co-founder of DLP Resources, is the qualified person of the Company as defined by National Instrument 43-101. Mr. Pighin has reviewed and approved the technical contents of this news release.

About DLP Resources Inc.

DLP Resources Inc. is a mineral exploration company operating in Southeastern British Columbia and Peru, exploring for Base Metals and Cobalt. DLP is listed on the TSX-V, trading symbol DLP and on the OTCQB, trading symbol DLPRF. Please refer to our web site www.dlpresourcesinc.com for additional information.

FOR FURTHER INFORMATION PLEASE CONTACT:

DLP RESOURCES INC.

Ian Gendall, CEO & President

Jim Stypula, Executive Chairman

Robin Sudo, Chief Financial Officer and Corporate Secretary

Maxwell Reinhart, Investor Relations

Telephone: 250-426-7808

Email: iangendall@dlpresourcesinc.com

Email: jimstypula@dlpresourcesinc.com

Email: robinsudo@dlpresourcesinc.com

Email: maxreinhart@dlpresourcesinc.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as “intends” or “anticipates”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “should”, “would” or “occur”. This information and these statements, referred to herein as “forward‐looking statements”, are not historical facts, are made as of the date of this news release and include without limitation, statements regarding discussions of future plans, estimates and forecasts and statements as to management’s expectations and intentions with respect to drilling on the Aurora Project in Peru.

These forward‐looking statements involve numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking statements. These risks and uncertainties include, among other things drill results expected from the Aurora Project in Peru.

Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws. We seek safe harbor.